Music streaming services of today have greatly improved from the peer-to-peer file sharing platforms of the 80s and 90s like Napster, Limewire, and Bittorrent. The revolution began in the 2000s with the introduction of Apple’s iTunes store, iPod, Spotify, and Pandora.

In 2021, music streaming apps experienced a surge, making $25.1 billion, marking a 32% jump from the previous year. The subscriber base also saw an uptick, with approximately 616.2 million people globally now choosing to listen to music through these services.

Today, the focus isn’t on individual sales, but on securing repeat listens and maintaining subscriptions. Gen Z and millennials have become the driving force behind this shift towards the subscription model.

In this comprehensive report, we’ll delve into the world of music streaming services. We’ll analyze their revenue figures, usage stats, and future forecasts to identify trends and evaluate the growing importance of these platforms.

- Key Music Streaming Services Statistics (2023)

- Breakdown of the Most Used Music Apps (2023)

- Music Streaming Global Market Report (2023): User Growth Rate and Usage Statistics

- User Engagement on Music Streaming Platforms (2023)

- Music Streaming Apps Downloads and Subscriptions Statistics (2023)

- Revenue and Market Share of Music Streaming Services 2023

- Music Streaming Market Penetration 2023

- Impact of streaming services on the music industry

- The Future of Music Streaming Services: Trends and Market Forecast

- Conclusion

Key Music Streaming Services Statistics (2023)

- $330 billion could be the massive value of the streaming industry by 2030, according to projections.

- $25.1 billion in revenue was earned by music streaming apps in 2021, a 32% jump compared to the previous year.

- 523.9 million global music subscribers were reached in 2021, during the Covid pandemic.

- 180 million subscribers make Spotify the most used and most subscribed to music streaming service.

- 60% of U.S households subscribe to at least one paid music streaming service.

- The most streamed genre in the U.S. is R&B/hip-hop music, setting the beat for the listeners.

Breakdown of the Most Used Music Apps (2023)

Each music streaming service stands out in terms of their offerings. In this table, we compare some of the key online music players in the industry, looking at their unique features and overall user ratings.

Comparison of Key Music Streaming Services (2023) – Features and User Ratings

| S/N | Service | Features | Rating |

| 1 | Spotify | Best music streaming service overall | 9.5/10 |

| 2 | Apple Music | Best alternative to Spotify, library of more than 100 million songs | 9/10 |

| 3 | Qobuz | Best for audiophiles, CD-quality streaming | 8.5/10 |

| 4 | Tidal | Best for rock and urban fans, highest royalty rates for artists, library of more than 100 million songs | 8.5/10 |

| 5 | Amazon Music Unlimited | Best for Prime members, library of more than 70 million songs | 8/10 |

| 6 | YouTube Music | Best for music videos, personalized playlists | 8/10 |

| 7 | Deezer | Best for international music, library of more than 73 million songs | 7.5/10 |

| 8 | Pandora Premium | Best for personalized radio stations, library of more than 70 million songs | 7.5/10 |

| 9 | LiveOne | Best for live music recordings, library of more than 15,000 concerts | 7/10 |

| 10 | SiriusXM Internet Radio | Best for satellite radio, library of more than 300 channels | 7/10 |

Music Streaming Global Market Report (2023): User Growth Rate and Usage Statistics

User Growth Rate of Music Streaming Services

Statista¹ states that the global music streaming subscriber base reached 616.2 million in the second quarter of 2022. Looking ahead, they anticipate a surge to 1.12 billion subscribers by 2027. This projection represents a compound annual growth rate (CAGR) of 10.6%, demonstrating a vibrant, rapidly expanding market.

Total Number of Active Music Streaming Users

Business of Apps predicts over 2.8 billion active users on platforms like YouTube, Spotify, Apple Music, Tencent Music, and Amazon Music in 2023.

Monthly Active Users on Music Streaming Apps

In Q1 2023, Spotify’s MAU rose 22% yearly to 515 million, according to Statista². By the end of 2022, Tencent’s music apps had 567 million MAU, whereas YouTube reported over two billion music users as of 2020.

Daily Number of Active Audio Streaming Users

Over 95.6% of Americans aged 13 and above, equivalent to over 315 million individuals, tune into audio content daily, spanning radio, podcasts, and digital audio formats. SXM Media reveals that most Americans listen to music daily, averaging 4.8 times across two platforms and devices.

Number of Active Music Streaming Users by Age Group

Statista³ provides an insightful breakdown of weekly active music streamers or downloaders in the US in 2020. Gen Z and Millennials led the pack in music streaming popularity, each with 73% of their age groups participating:

Title: Active Music Streaming Users by Age Group

| Age group | Percentage | Generation |

| 15-25 | 73% | Gen Z |

| 26-35 | 73% | Millennials |

| 36-45 | 66% | Millennials |

| 46-55 | 57% | Gen X |

| 56-65 | 48% | Baby Boomers |

| 66+ | 34% | Silent Generation |

All Sources: Statista¹, Business of Apps, Statista², SXM Media, and Statista³.

User Engagement on Music Streaming Platforms (2023)

Frequency and Duration of Streaming Music

The IFPI report states that people worldwide listened to music for an average of 18.4 hours each week in 2021. It also indicates that music streaming platforms like Spotify, Apple Music, and Deezer accounted for 32% of the weekly music engagement.

Annual Trend of Music Listening

| Year | Average Weekly Music Listening Duration |

| 2021 | 18.4 hours |

| 2020 | Not Available (Pandemic) |

| 2019 | 18 hours |

| 2018 | 17.8 hours |

Average Listening Time on Music Streaming Services

On March 31, 2023, Luminate reported that audio streams impressively crossed one trillion in just three months. Statista notes music streamers listen for about 19.11 hours weekly or 81.9 hours monthly. Apple Music leads in listener duration, closely followed by Spotify users averaging 25 hours monthly. Americans stream music for about 75 minutes daily.

Popular Music Genres or Categories on Streaming Apps

A survey of 3000 participants by DiMA showed streaming services as the main discovery point for several music genres: Americana (74%), Afro-Pop/Afro-Beats (73%), K-Pop (68%), and Latin Music (55%). The most growth in streaming was seen in Afro Pop/Afro Beat (66%), Americana (60%), Christian/Gospel (60%), K-Pop (59%), Latin Music (58%), and EDM (56%).

Music Genres: Discovery and Growth Through Streaming Services

| Muisc Genre | % Introduced Via Streaming | % Increase in Listening |

| Americana | 74% | 60% |

| Afro-Pop/Afro-Beat | 73% | 66% |

| K-Pop | 68% | 59% |

| Latin Music | 55% | 58% |

| Christian/Gospel | N/A | 60% |

| EDM | N/A | 56% |

(Source: 2023 DiMA Fan Engagement Report. Note: The above table presents the percentage of respondents who first discovered each genre via streaming services, as well as the growth in listening for each genre among streamers.)

Most Streamed Songs on Streaming Platforms

American Songwriter lists 2023’s top streamed songs as Miley Cyrus’ “Flowers”, SZA’s “Kill Bill”, The Weeknd’s “Die For You”, Bizzarap and Shakira’s “Shakira: BZRP Music Sessions, Vol. 53”, and Rema and Selena Gomez’s “Calm Down”.

Topsify’s Global Top 50 Hits playlist on Spotify includes tracks like “Dance The Night” by Dua Lipa and “Baby Don’t Hurt Me” by David Guetta, Anne-Marie, and Coi Leray.

Luminate reports “Flowers” as the most streamed song in 2023 with 1.16 billion streams, followed by “Kill Bill” with 885 million streams.

Most Streamed Songs on Music Apps 2023

| Song | Artist(s) | Global Audio Streams |

| Flowers | Miley Cyrus | 1.16 billion |

| Kill Bill | SZA | 885 million |

| Die For You | The Weeknd | N/A |

| Shakira:BZRP Music Sessions, Vol. 53 | Bizzarap, Shakira | N/A |

| Calm Down | Rema, Selena Gomez | N/A |

| Dance The Night | Dua Lipa | N/A |

| Baby Don’t Hurt Me | David Guetta, Anne-Marie, Coi Leray | N/A |

| 10:35 | Tiësto, Tate McRae | N/A |

(Source: Multiple sources)

All Sources: IFPI, Luminate, Statista, DiMA, American Songwriter, and Topsify’s Global Top 50.

Music Streaming Apps Downloads and Subscriptions Statistics (2023)

Music Apps with the Most Downloads

Spotify took the lead as the most downloaded music and audio app across the globe on the Google Play Store in September 2022, recording nearly 12 million downloads from Android users, according to Statista. Coming in at a close second was Shazam, with about 5.44 million Android downloads worldwide.

Growth Rate of Music Streaming App Subscriptions

IFPI’s data reveals an unstoppable growth trend in streaming subscriptions over the last ten years. From a humble beginning of 8 million users in 2010, paid music subscriptions exploded past the 100 million mark by 2016. Incredibly, over the next five years, these numbers magnified nearly five times.

Total Number of Global Music Subscribers

The IFPI Report reveals a total of 589 million paid music subscription accounts worldwide by the close of 2022. This represents a substantial increase from the 523 million accounts reported in the preceding 12 months and the 443 million accounts in 2020.

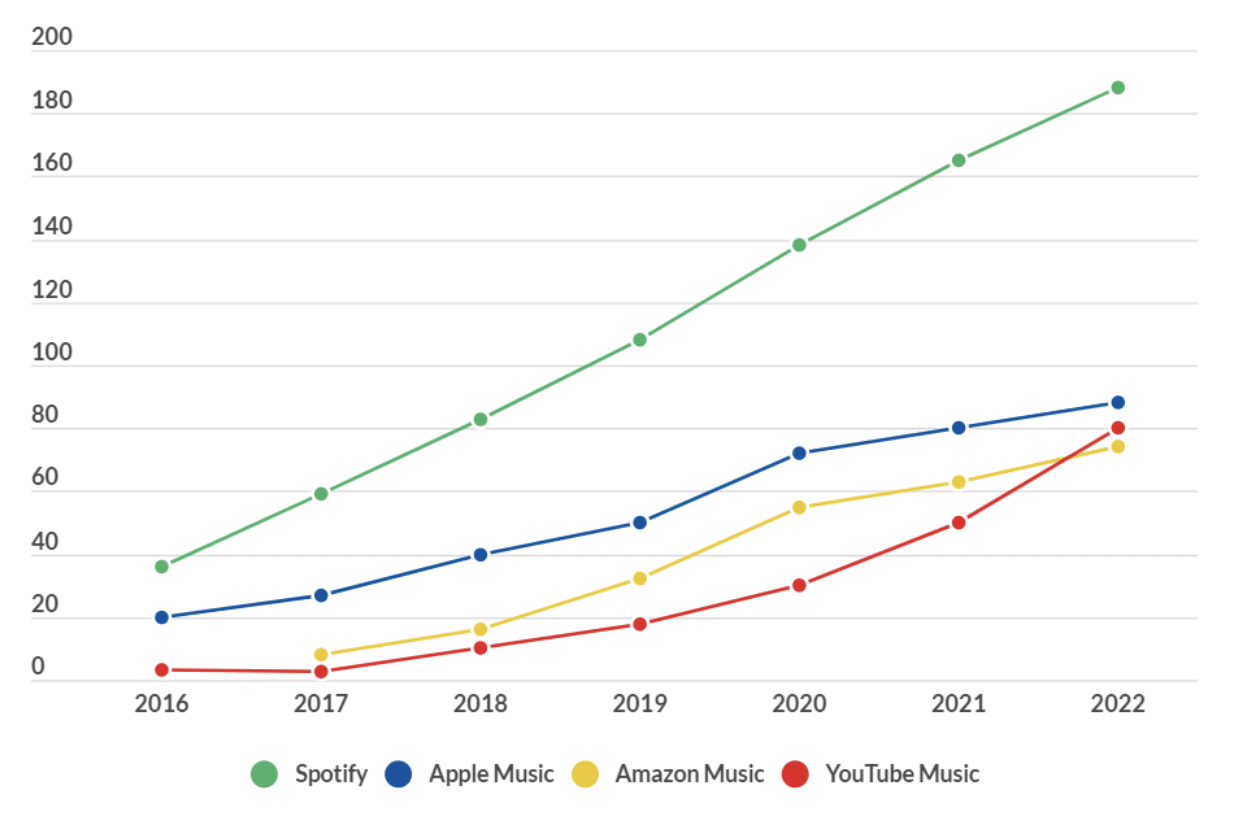

Music Streaming Apps with the Highest Subscribers

Spotify proudly holds the record for the most subscribers, with a tally exceeding 180 million. However, the IFPI notes that Spotify falls short in the global race, possessing less than a third of the total music subscriber base worldwide.

Streaming Apps and Subscribers

| Streaming Service | Subscribers |

| Spotify | Over 180 million |

| Apple Music | Over 72 million |

| Amazon Music Unlimited | Over 55 million |

| YouTube Music | Over 80 million |

(Source: Multiple sources)

All Sources: Statista and IFPI.

Revenue and Market Share of Music Streaming Services 2023

Global Music Streaming Revenue Statistics

In its eighth consecutive growth year, 2022 global music sales rose to $26.2 billion, a 9% increase from last year, according to IFPI. Paid-for streaming subscriptions largely drove this growth with a 10.3% revenue increase to $12.7 billion. Overall, streaming, both paid and ad-supported, represented 67% of music industry sales.

Revenue Generated by Top Music Streaming Services

Preference often means increased users and high revenue. Regionally, the U.S. prefers Spotify, Apple Music, and Amazon Music (IBIS World). Europe favors Spotify, Deezer, and Apple Music (Statista¹), while Asia leans towards Spotify, Apple Music, and Joox (The Asean Post). Latin America’s top choices are Spotify, YouTube Music, and Deezer (RIAA¹).

Music Streaming Services and Revenue by Region

| Region | Top Streaming Service | Second Streaming Service | Third Streaming Service |

| Global | Spotify | Apple Music | Tencent Music |

| United States | Spotify | Apple Music | Amazon Music |

| Europe | Spotify | Deezer | Apple Music |

| Asia | Spotify | Apple Music | Joox |

| Latin America | Spotify | YouTube Music | Deezer |

(Source: Multiple sources)

Revenue of Music Streaming Apps in the US

According to RIAA², music streaming accounts for 84% of the US music industry’s revenue, with paid subscriptions contributing the majority. In the first half of 2021, these paid subscriptions generated $4.6 billion, marking a 26% annual increase.

Market Share of Music Streaming Apps

Per the IMS Business Report 2023, Spotify leads with 30.5% of the market share. Following are Apple Music (13.7%), Tencent Music (13.4%), Amazon Music (13.3%), and YouTube Music (8.9%). Other services like Deezer, Yandex, NetEase, and more hold the rest of the market share.

Music Apps’ Market Share

| Streaming Service | Market Share |

| Spotify | 30.5% |

| Apple Music | 13.7% |

| Tencent Music | 13.4% |

| Amazon Music | 13.3% |

| YouTube Music | 8.9% |

| Other Services (Deezer, Yandex, NetEase, etc.) | Remaining % |

(Source: IMS Business Report)

Music Streaming Market Penetration 2023

Statista² projects the music streaming market revenue to hit US$25.71 billion in 2023, boasting a global user penetration of 12.0%.

The US is poised to lead in revenue generation with US$10.20 billion and have the highest user penetration at 40.3% in 2023. Other significant regions include Asia, China, Japan, France, and the UK.

However, Persistence Market Research provides a higher estimate, anticipating the music streaming market’s worth to reach US$34,129.3 million in 2023. They also predict a compound annual growth rate of 13.8% from 2023 to 2033.

All sources: IFPI, IBIS World, Statista¹, The Asean Post, RIAA¹, RIAA², IMS Business Report, Statista², and Persistence Market Research.

Impact of streaming services on the music industry

Artist Revenue from Streaming Services

Artists earn royalties based on their share of total streams, known as Streamshare. Payments are relatively uniform across the industry, with Spotify paying about $0.0032 per stream and Apple Music paying $0.0056 per stream according to Louder Sound. However, the exact payment per stream can vary due to factors like subscription type, streaming country, and label agreements.

Here’s a simplified and concise graphic table showing music streaming royalties and payouts in 2022:

Changes in Music Consumption Patterns

Gitnux’s blog post spotlighted some unexpected music consumption patterns in 2023. Key trends include the use of social media platforms as music discovery channels, the resurgence of vinyl records and cassette tapes, the growing appeal of podcasts and audiobooks, and the birth of new genres and subcultures shaped by global events and movements.

All Sources: Louder Sound, Producer Hive, and Gitnux.

The Future of Music Streaming Services: Trends and Market Forecast

Emerging Trends in Music Streaming 2023

Emerging music streaming trends include personalized AI-driven recommendations and interactive experiences like virtual concerts. Other expected developments mentioned by DataArt are:

- Audio programmatic and enhanced metadata for better discovery and monetization.

- Immersive experiences through virtual concerts and metaverse platforms.

- Web3 and NFTs reshaping ownership and value creation.

- Non-DSP streaming and targeted recommendations for niche audiences.

- Lossless streaming and video-related discovery enhancing quality and engagement.

- Global industry growth driven by streaming volume, pricing, and platforms.

TikTok’s continued role as a primary music discovery tool, particularly for Gen Z, is an emerging trend that could lead to a hybrid scenario of music meeting videos.

Market Forecast for Music Streaming Services 2023

Globe Newswire projected the global music streaming market to grow significantly between 2023 and 2030, with a CAGR of 14.94% from 2023 to 2028. Spotify leads the market with a 30.5% share, trailed by Apple Music, Tencent Music, Amazon Music, and YouTube Music. The music subscription market is set to swell to USD 73.57 billion by 2028, a massive increase from USD 28.2 billion in 2021.

Challenges and Opportunities in Music Streaming Services 2023

Despite challenges like increasing demands for royalties from songwriters and publishers, and the struggle for long and mid-tail artists to balance streaming economics, the music streaming industry continues to grow. Independent artists have opportunities to thrive in this evolving landscape. The market growth is fuelled by the widespread use of smartphones and easy internet access, particularly among the 18-40 age demographic, who show a preference for free music through platforms.

All Sources: DataArt, Globe Newswire.

Conclusion

The future of the music streaming industry shows promising growth despite challenges. Emerging technologies such as AI are transforming the industry, enhancing user experiences, and redefining ownership and value creation. Major players, like Spotify, Apple Music, Tencent Music, Amazon Music, and YouTube Music, dominate the market, but opportunities exist for independent artists and niche platforms. As consumer behaviors shift and technology evolves, music streaming continues to adapt and innovate, fuelled notably by younger demographics and easy access to digital platforms.